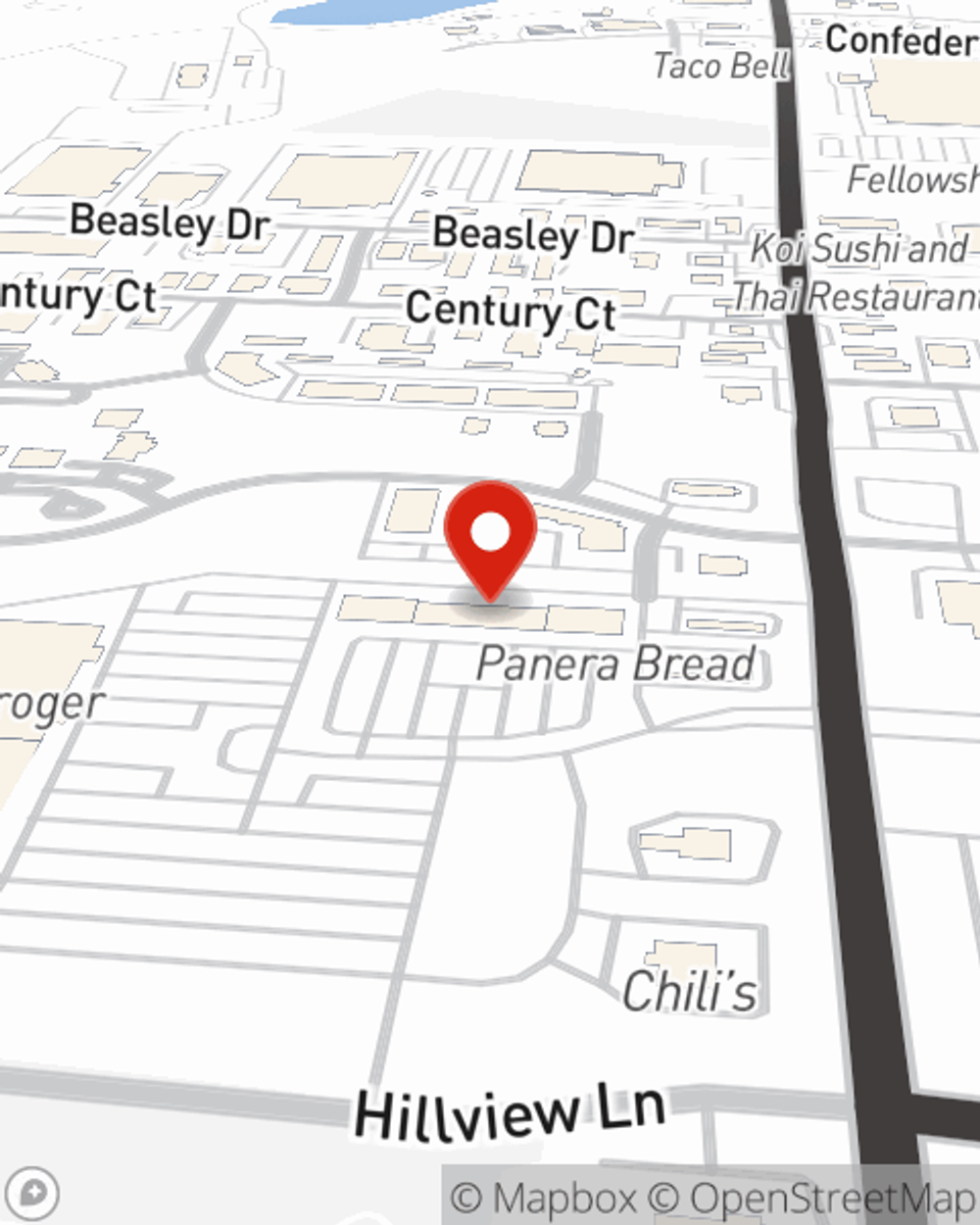

Business Insurance in and around Franklin

Franklin! Look no further for small business insurance.

Cover all the bases for your small business

- Nashville

- Spring Hill

- Columbia

- Thompsons Station

- Nolensville

- Fairview

- Birmingham

- Huntsville

- South Haven

- Olive Branch

- Brentwood

- College Grove

- Lewisburg

- Lawrenceburg

- Pulaski

- Mount Pleasant

- Mount Juliet

- Hendersonville

- Gallatin

- White House

- Williamson County

- Davidson County

- Maury County

- Cheatham County

Insure The Business You've Built.

Small business owners like you wear a lot of hats. From product developer to customer service rep, you do as much as possible each day to make your business a success. Are you a pet groomer, a lawn care service or an optician? Do you own a janitorial service, a clothing store or an antique store? Whatever you do, State Farm may have small business insurance to cover it.

Franklin! Look no further for small business insurance.

Cover all the bases for your small business

Strictly Business With State Farm

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Scott Koon. With an agent like Scott Koon, your coverage can include great options, such as commercial auto, worker’s compensation and business owners policies.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Scott Koon's team to review the options specifically available to you!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Scott Koon

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.